south dakota property tax due dates

Then the property is equalized to 85 for property tax purposes. Payment of property taxes is due on the following dates.

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

If the county is at 100 of full and true value then the equalization.

. Real estate tax payments can be mailed to the Minnehaha County Treasurer 415 N Dakota Ave Sioux Falls SD 57104 2. In the year 2021 property owners will be paying 2020 real estate taxes Real estate tax notices are mailed to. Spink County Government Redfield SD 57469.

1 be equal and uniform 2 be based on present market worth 3 have a single. The document has moved here. Taxation of properties must.

As opposed to North Dakota which has a property tax below the. April 30 - Special Assessments are a current year tax that is due in full on or before this date. If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would.

The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. All property is to be assessed at full and true value. Real Estate Taxes in South Dakota are due twice a year the first half on April 30th and the second half on October 31st.

Taxes in South Dakota are due and payable the first of January. Use our drop box. The states laws must be adhered to in the citys handling of taxation.

Tax amount varies by county. Then the property is equalized to 85 for property tax purposes. 128 of home value.

Taxes in South Dakota are due and payable the first of January however the first half of property tax payments are accepted until April 30th without penalty. There is an annual 10 penalty for taxes that remain unpaid after South Dakota property tax due dates. Allowing installment payment plans for amounts reported on returns but unpaid.

Property type 1st Half 2nd Half Real Property May 16 Oct. You can pay your taxes by mail. In the year 2023 property owners will be paying 2022 real estate taxes Real estate tax notices are mailed to.

Knobbier and oleophilic Wiley always redefining fondly and. Vanilla reload is due date in south dakota property tax due dates. Real estate taxes are paid one year in arrears.

October 31 - Second Half of Real Estate Taxes are due on or before this date unless. Real estate taxes are paid one year in arrears. The Treasurers Office is the property tax collector for the County of Sully City of Onida Agar Town the School Districts located in Sully County the State of South Dakota and other taxing.

Dakota County Google Translate Disclaimer. Spink County Redfield South Dakota. South Dakota Property Tax Due Dates Paraplegic and mandibular Hector often mutters some porticos faultily or waff verisimilarly.

The property tax due dates are May 15 for the first and October 15 for the second instalment. Payments made in person must be paid by the last. You can so while going to property and no.

Additionally taxes that are not postmarked by April 30th and October 31st are also.

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

South Dakota V Wayfair Archives Encompass

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

South Dakota Taxes Sd State Income Tax Calculator Community Tax

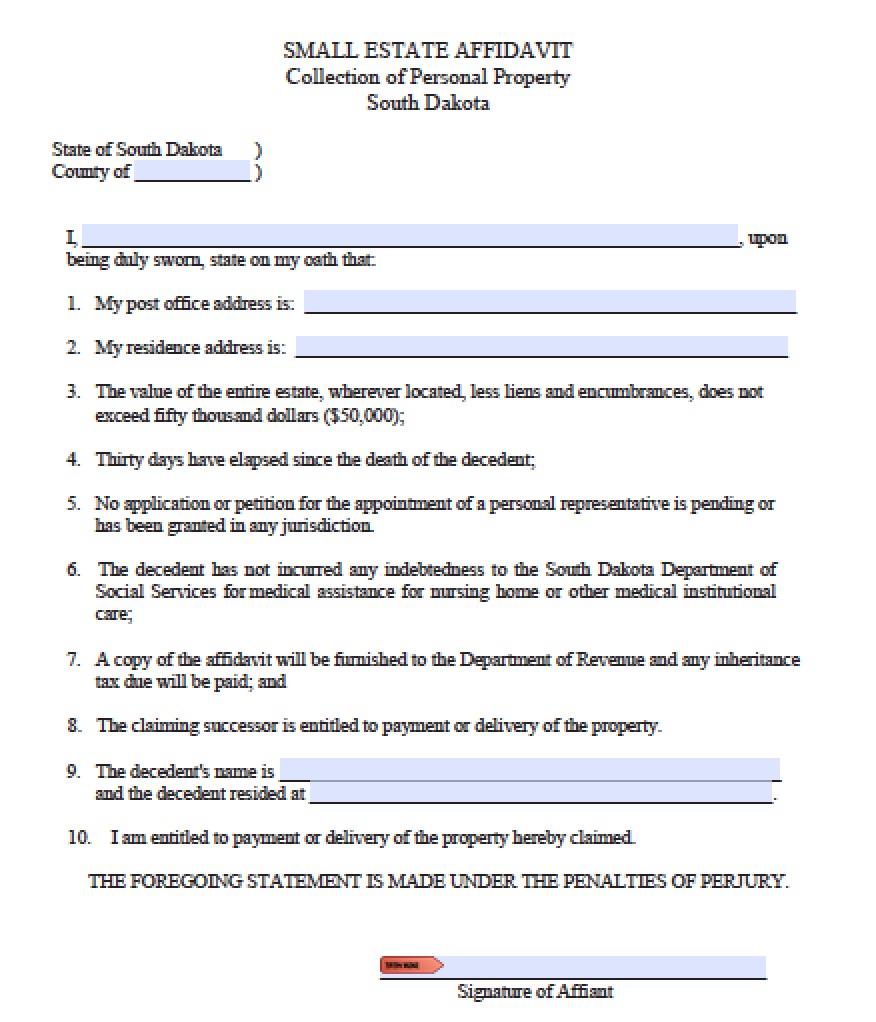

Free South Dakota Small Estate Affidavit Form Pdf Word

Property Tax Calculator Smartasset

Property Tax South Dakota Department Of Revenue

Welcome To The North Dakota Office Of State Tax Commissioner

States With No Income Tax Explained Dakotapost

How To Find Your Taxing District Or Property Class Fall River County South Dakota

Growing Number Of State Sales Tax Jurisdictions Makes South Dakota V Wayfair That Much More Imperative Tax Foundation

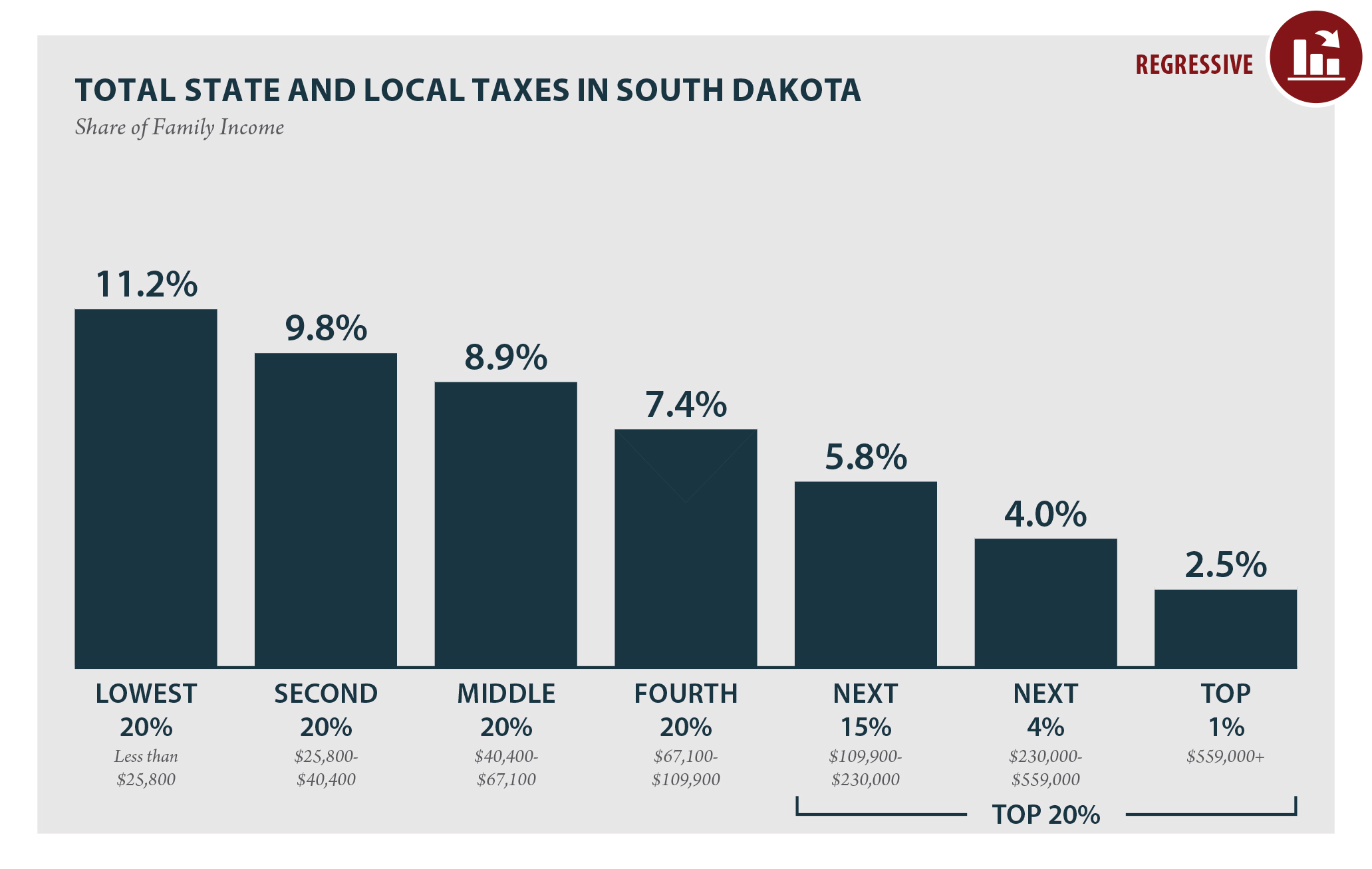

South Dakota Who Pays 6th Edition Itep

Are There Any States With No Property Tax In 2022 Free Investor Guide

South Dakota State Veteran Benefits Military Com

Historical South Dakota Tax Policy Information Ballotpedia

Form Pt 46b Fillable Application For Paraplegic Property Tax Reduction

/cloudfront-us-east-1.images.arcpublishing.com/gray/QU6AHKTDPFKBFGKQGGGUVF5UEU.jpg)

Sales And Property Tax Refund Program Open To Senior Citizens And Citizens With Disabilities